2026 County Loan Limits for Conventional and FHA Home Loan Financing

The BuildBuyRefi Team Offers Non-Conforming Options Up to $3 Million +

Written by the Build Buy Refi Lending Team | NMLS# 411500 | Last Updated: November 30, 2025

Our mortgage professionals have guided tens of thousands of borrowers through loan limit changes over the past decade, helping clients across all 50 states navigate construction loans, renovation financing, manufactured home purchases, and traditional home buying.

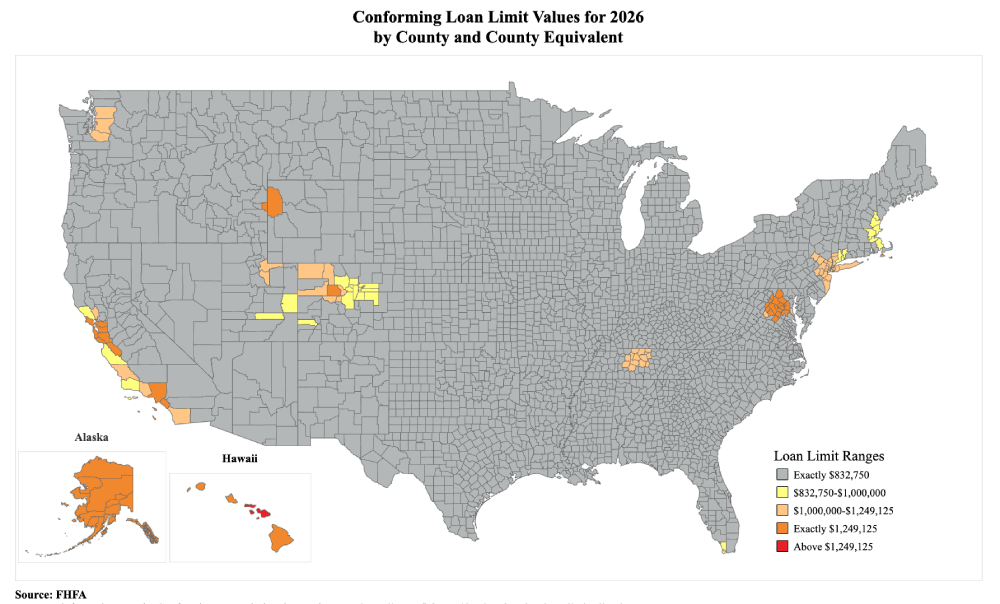

Whether you're planning to build a custom home, purchase a manufactured or modular home, renovate an existing property, or buy your next residence, understanding the 2026 conforming loan limits is an essential step in mapping out your financing. The Federal Housing Finance Agency (FHFA) released updated limits on November 25, 2025, which take effect January 1, 2026.

What Changed for 2026? Understanding the New Conforming Loan Limits

The FHFA adjusts conforming loan limits annually based on changes in average U.S. home prices. For 2026, the baseline limit for a single-family home rises to $832,750, up $26,250 from the 2025 limit of $806,500. This reflects a 3.26% increase, tied to FHFA House Price Index data for the third quarter of 2025.

Conforming loans are mortgages that fall within the limits set by Fannie Mae and Freddie Mac. When your loan amount stays within these thresholds, you typically benefit from more competitive interest rates and streamlined underwriting compared to jumbo loans, which exceed these limits and often carry stricter qualification requirements.

For borrowers in high-cost housing markets, the ceiling limit also increased. The new maximum for high-cost areas is $1,249,125 for a one-unit property, which represents 150% of the baseline. If you're purchasing in a county where 115% of the local median home value exceeds the baseline, your county may qualify for a limit somewhere between the baseline and this ceiling.

2026 Conventional Conforming Loan Limits

Baseline Limits for Most U.S. Counties

The baseline limits apply to the majority of U.S. counties. Over 3,000 counties use these standard figures:

| Property Type | 2026 Baseline Limit |

|---|---|

| 1 Unit | $832,750 |

| 2 Units | $1,066,250 |

| 3 Units | $1,288,800 |

| 4 Units | $1,601,750 |

High-Cost Area Limits

Approximately 160 counties qualify for higher limits due to elevated median home values. The ceiling for these high-cost areas is capped at 150% of the baseline:

| Property Type | 2026 High-Cost Ceiling |

|---|---|

| 1 Unit | $1,249,125 |

| 2 Units | $1,599,375 |

| 3 Units | $1,933,200 |

| 4 Units | $2,402,625 |

Many counties fall between these two thresholds. The FHFA calculates each county's specific limit based on 115% of the local median home value within its metropolitan or micropolitan statistical area.

Special Statutory Areas (Alaska, Hawaii, Guam, U.S. Virgin Islands)

Federal law establishes higher baseline limits for Alaska, Hawaii, Guam, and the U.S. Virgin Islands due to elevated construction and living costs. In these areas, the baseline starts at 150% of the national baseline, and the ceiling reaches 150% of that elevated baseline:

| Property Type | 2026 Baseline | 2026 Ceiling |

|---|---|---|

| 1 Unit | $1,249,125 | $1,873,675 |

| 2 Units | $1,599,375 | $2,399,050 |

| 3 Units | $1,933,200 | $2,899,800 |

| 4 Units | $2,402,625 | $3,603,925 |

2026 FHA Loan Limits

FHA loans follow their own limit structure, calculated as a percentage of the FHFA conforming limits. The Department of Housing and Urban Development (HUD) sets FHA floors at 65% of the conforming baseline and caps at 150% of the baseline (matching the conforming high-cost ceiling).

Standard FHA Limits (Low-Cost Areas)

| Property Type | 2026 FHA Floor |

|---|---|

| 1 Unit | $541,288 |

| 2 Units | $693,063 |

| 3 Units | $837,720 |

| 4 Units | $1,041,138 |

FHA High-Cost Area Limits

In markets where home values support it, FHA limits can reach the ceiling:

| Property Type | 2026 FHA Ceiling |

|---|---|

| 1 Unit | $1,249,125 |

| 2 Units | $1,599,375 |

| 3 Units | $1,933,200 |

| 4 Units | $2,402,625 |

FHA Special Exception Areas

Alaska, Hawaii, Guam, and the U.S. Virgin Islands receive even higher FHA limits:

| Property Type | 2026 FHA Special Area Limit |

|---|---|

| 1 Unit | $1,873,688 |

| 2 Units | $2,399,063 |

| 3 Units | $2,899,800 |

| 4 Units | $3,603,938 |

FHA financing continues to serve first-time buyers and borrowers with moderate incomes, offering lower down payment requirements and more flexible credit guidelines than conventional options. If you're considering an FHA 203(k) renovation loan to purchase and update an older home, these same limits apply.

How Loan Limits Apply to Different Loan Programs

The conforming loan limits published by FHFA apply directly to conventional loans backed by Fannie Mae and Freddie Mac, as well as FHA loans administered by HUD. However, two other major loan programs work differently.

VA Loans and Entitlement

Since the Blue Water Navy Vietnam Veterans Act took effect in January 2020, VA loans no longer have a strict loan limit for veterans with full entitlement. If you have your full VA entitlement available, you can finance a home above the county limit with no down payment required, subject to lender approval and your ability to qualify.

Veterans with partial entitlement (typically those with an existing VA loan or a previous foreclosure) may still reference the FHFA county limits when calculating their available entitlement. The 2026 figures can serve as a useful benchmark in those situations.

For more details on VA financing, including construction and renovation options, visit our VA home loan programs page.

USDA Loans and Income-Based Qualification

USDA Rural Development loans operate under a different framework altogether. Rather than county-based loan limits like conventional or FHA financing, USDA eligibility depends primarily on the borrower's household income and debt-to-income ratio, along with the property's location in a designated rural area.

While USDA does reference area loan limits for specific calculations, the primary constraints are income caps (typically 115% of the area median income) and the program's geographic requirements. If you're looking to purchase or build in a rural community, our team can help you determine whether USDA financing is a good fit for your situation. Learn more on our USDA Rural Development home loan programs page.

Historical Conforming Loan Limits (2023-2026)

Tracking how limits have changed over recent years can help you understand the trajectory of the housing market and plan your financing accordingly.

| Year | 1 Unit Baseline | 1 Unit High-Cost Ceiling | % Change |

|---|---|---|---|

| 2023 | $726,200 | $1,089,300 | — |

| 2024 | $766,550 | $1,149,825 | +5.56% |

| 2025 | $806,500 | $1,209,750 | +5.21% |

| 2026 | $832,750 | $1,249,125 | +3.26% |

The 3.26% increase for 2026 represents a slower pace of growth compared to recent years, reflecting a moderation in home price appreciation according to FHFA's third-quarter data.

Multi-Unit Historical Comparison (Baseline Limits)

| Year | 1 Unit | 2 Units | 3 Units | 4 Units |

|---|---|---|---|---|

| 2023 | $726,200 | $929,850 | $1,123,900 | $1,396,800 |

| 2024 | $766,550 | $981,500 | $1,186,350 | $1,474,400 |

| 2025 | $806,500 | $1,033,000 | $1,248,150 | $1,551,250 |

| 2026 | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

How These Limits Affect Your Home Financing Options

The increased conforming loan limits for 2026 expand what's possible for borrowers across a range of scenarios:

Building a New Home: If you're planning to construct a custom site-built home, these limits determine the maximum loan amount available through conventional or FHA construction financing. Our one-time and two-time close construction loan programs combine construction and permanent financing into a single loan, simplifying the process and locking in your rate upfront.

Purchasing a Manufactured or Modular Home: Buyers working with dealers to place a manufactured or modular home on their land can use these limits to gauge their financing options. The same conforming thresholds apply, and FHA offers specific programs for manufactured housing.

Renovating an Existing Property: Renovation loans like the FHA 203(k) or VA renovation loan allow you to finance both the purchase price and the cost of improvements. The 2026 limits set the ceiling for these combined amounts. Learn more about your options on our renovation loan programs page.

Buying an Existing Home: For straightforward purchase transactions, staying within the conforming limit typically means access to better rates and terms. Our purchase loan programs page outlines the options available across FHA, USDA, VA, and conventional financing.

When Your Loan Exceeds These Limits: If the home you're eyeing requires financing above your county's conforming limit, jumbo loan options are available. Build Buy Refi offers non-conforming solutions up to $3 million and beyond. Visit our jumbo loan programs page to explore these options.

Frequently Asked Questions About 2026 Loan Limits

What are the 2026 conforming loan limits?

For 2026, the baseline conforming loan limit for a single-family home is $832,750 in most U.S. counties. This represents a $26,250 increase from the 2025 limit of $806,500. In high-cost areas where median home values exceed certain thresholds, limits can reach up to $1,249,125 for a one-unit property. Multi-unit properties have higher limits: $1,066,250 for duplexes, $1,288,800 for triplexes, and $1,601,750 for four-unit properties at the baseline level.

How do FHA loan limits differ from conventional limits?

FHA loan limits are calculated based on the FHFA conforming limits but use different percentages. The FHA floor (minimum limit in low-cost areas) is set at 65% of the conforming baseline, which equals $541,288 for a one-unit property in 2026. The FHA ceiling matches the conforming high-cost limit at $1,249,125. This means FHA limits range between these two figures depending on your county's median home values. FHA loans also have different qualification requirements, including lower down payments and more flexible credit guidelines.

Do VA loans have loan limits in 2026?

For veterans with full entitlement, VA loans effectively have no loan limit. The Blue Water Navy Vietnam Veterans Act of 2019, which took effect January 1, 2020, eliminated loan limits for eligible veterans who have their full entitlement available. This means qualified veterans can purchase homes above the conforming limit with no down payment, subject to lender approval and their ability to qualify based on income and credit. Veterans with partial entitlement (those with existing VA loans or previous foreclosures affecting their entitlement) may still need to reference county limits when calculating available benefits.

When do the 2026 loan limits take effect?

The 2026 conforming loan limits take effect on January 1, 2026. According to Fannie Mae guidance, the new limits apply to whole loans delivered and mortgage loans delivered into mortgage-backed securities with pool issue dates on or after January 1, 2026. If you're closing on a home purchase in late December 2025, your loan would typically fall under the 2025 limits unless delivery occurs in 2026.

How is my county's loan limit determined?

County loan limits are determined by the FHFA based on local median home values within metropolitan or micropolitan statistical areas (CBSAs). If 115% of the highest median home value in a county's statistical area exceeds the baseline limit, that county qualifies for a higher limit. The limit is set at 115% of the local median, capped at 150% of the baseline (the ceiling). Counties that don't meet this threshold use the baseline limit. The FHFA publishes a complete list of county-by-county limits each November.

What happens if my loan amount exceeds my county's limit?

When your loan amount exceeds your county's conforming limit, you'll need a jumbo loan (also called a non-conforming loan). Jumbo loans typically have stricter qualification requirements, including higher credit score minimums, larger down payments, and more documentation. Interest rates on jumbo loans may be slightly higher than conforming rates, though this varies by lender and market conditions. Build Buy Refi offers jumbo financing options up to $3 million and beyond for borrowers who need to exceed conforming limits.

Are conforming loan limits the same as FHA loan limits?

No, they're related but different. Conforming loan limits apply to conventional loans backed by Fannie Mae and Freddie Mac. FHA loan limits are set by HUD and calculated as percentages of the conforming limits. In high-cost areas, FHA and conforming ceilings are the same ($1,249,125 for 2026). In low-cost areas, FHA limits are lower than conforming limits because the FHA floor is 65% of the conforming baseline. Always check both limit types when comparing conventional and FHA financing options.

Do these limits apply to construction loans?

Yes, conforming loan limits apply to construction loans when the permanent financing will be a conforming mortgage. For one-time close construction loans where construction and permanent financing are combined, the total loan amount must fall within your county's limit to qualify as conforming. If your construction costs plus land exceed the limit, you may need a jumbo construction loan or alternative financing. FHA and VA also offer construction loan programs subject to their respective limits.

Can loan limits decrease from year to year?

No, conforming loan limits cannot decrease under current FHFA guidelines. The Housing and Economic Recovery Act of 2008 (HERA) specifies that limits remain flat when home prices decline and only increase when prices rise enough to exceed previous peaks. This "hold harmless" approach also applies at the county level, meaning individual county limits won't drop even if local median home values decrease. This provides stability for borrowers and the housing market.

How do loan limits affect refinancing?

When refinancing, the loan amount on your new mortgage must fall within current conforming limits to qualify as a conforming loan. If your existing loan balance plus any cash-out amount exceeds your county's 2026 limit, you'd need jumbo refinancing. For rate-and-term refinances where you're simply replacing your existing mortgage, the new conforming limits may allow you to refinance into a conforming loan even if your original mortgage was a jumbo loan, potentially accessing better rates and terms.

Ready to Build, Buy, or Refinance?

The 2026 loan limits create new opportunities, whether you're starting from the ground up with a construction loan, updating an older property with renovation financing, or purchasing your next home. Our team at Build Buy Refi specializes in guiding borrowers through these options and matching you with the right program for your goals.

We can help you understand how your county's specific limits affect your financing, compare conventional and FHA options, and determine whether VA or USDA programs might work for your situation. When your needs exceed conforming limits, we have non-conforming solutions available as well.

Contact us today by phone, chat, or through our eligibility quiz to start the conversation. Loan limits and program guidelines can change, so working with a knowledgeable mortgage professional ensures you have current information tailored to your circumstances.

Sources and Official References

The loan limit figures on this page are sourced from official government publications:

Federal Housing Finance Agency (FHFA), "Conforming Loan Limit Values for 2026," published November 25, 2025. Available at fhfa.gov/CLL

FHFA 2026 Conforming Loan Limit Addendum detailing calculation methodology

FHFA Conforming Loan Limit FAQs

Fannie Mae Lender Letter LL-2025-04

FHA loan limits are calculated based on HUD guidelines using 65% of the conforming baseline for floors and 150% for ceilings. Official FHA limits are published by the Department of Housing and Urban Development.

Disclaimer: The figures on this page reflect FHFA's November 2025 announcement for 2026 conforming loan limits. Specific county limits and program details may vary. Always verify current limits with your loan officer, as guidelines are subject to change.

About Build Buy Refi Home Loans

Build Buy Refi Home Loans, powered by The Federal Savings Bank (NMLS# 411500), is a nationwide mortgage lender specializing in construction loans, renovation financing, manufactured and modular home purchases, traditional home purchases, refinancing, and HELOCs. Our team of licensed mortgage professionals has helped tens of thousands of borrowers across all 50 states navigate the home financing process.

We maintain an A+ rating with the Better Business Bureau and have been recognized by industry publications for our expertise in construction and renovation lending. Our loan officers hold individual NMLS licenses and complete ongoing education to stay current with program guidelines and regulatory requirements.